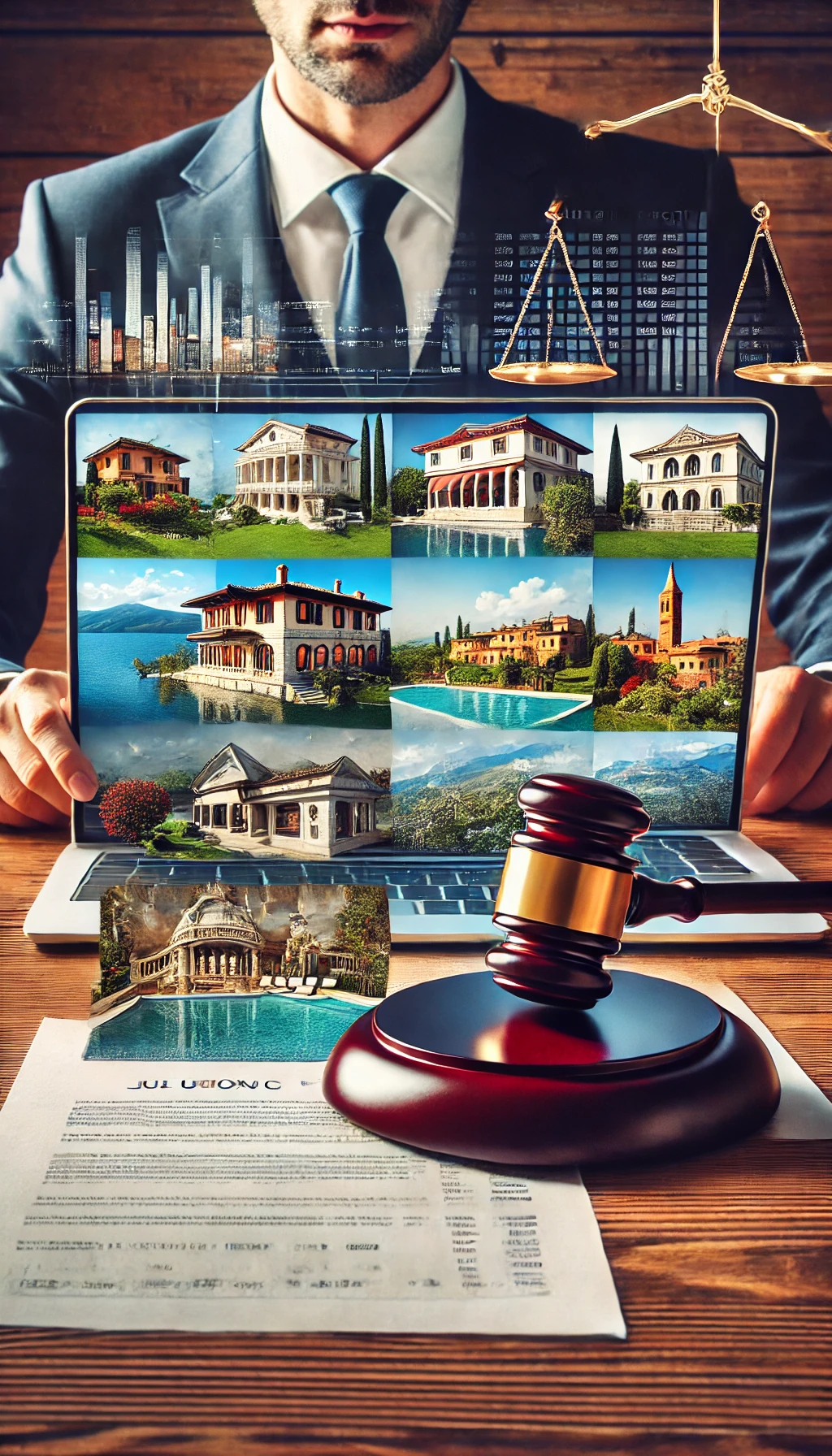

At OS Law, we understand the value and potential of Italy’s real estate market. Judicial real estate auctions offer a unique opportunity to acquire prestigious properties, including lakeside and seaside villas, Tuscan estates, and renowned wineries, at highly competitive prices. Our expert legal team is dedicated to guiding clients through this intricate process, ensuring a seamless and informed experience.

Advantages of Real Estate Judicial Auctions

Real estate judicial auctions provide a platform to purchase high-value properties at a fraction of their market cost. This method of acquisition is particularly advantageous for those seeking diverse property options across Italy, from serene lakeside villas to sprawling Tuscan estates.

Comprehensive Legal Support

Navigating the complexities of judicial auctions requires a thorough understanding of the legal landscape. Our team of specialized lawyers at OS Law offers comprehensive support by:

– Reviewing critical documents such as the sale notice and the appraisal report.

– Ensuring clients are fully informed about property details, potential liabilities, and additional costs.

– Providing expert analysis of appraisal reports and understanding of sale notices.

– Identifying third-party rights and legal restrictions.

– Evaluating building code violations and their rectifications.

Expertise in Italian Non-Performing Loans (NPL)

In addition to judicial auctions, OS Law supports clients in exploring the broader Italian real estate market, particularly in the realm of Non-performing loans (NPL). Despite the challenges posed by high NPL levels, the market presents significant opportunities for investors due to the potential for high returns.

Investing in NPLs in Italy

– Diverse Asset Pool: NPL portfolios include a wide range of properties, such as residential, commercial, and industrial, offering various investment options.

– Discounted Prices: Properties within NPL portfolios are available at substantial discounts, making them attractive investment opportunities.

Explore Your Opportunities with OS Law

Our legal expertise ensures that clients maximize their investments, whether through real estate judicial auctions or NPL opportunities.